| Net revenues |

|

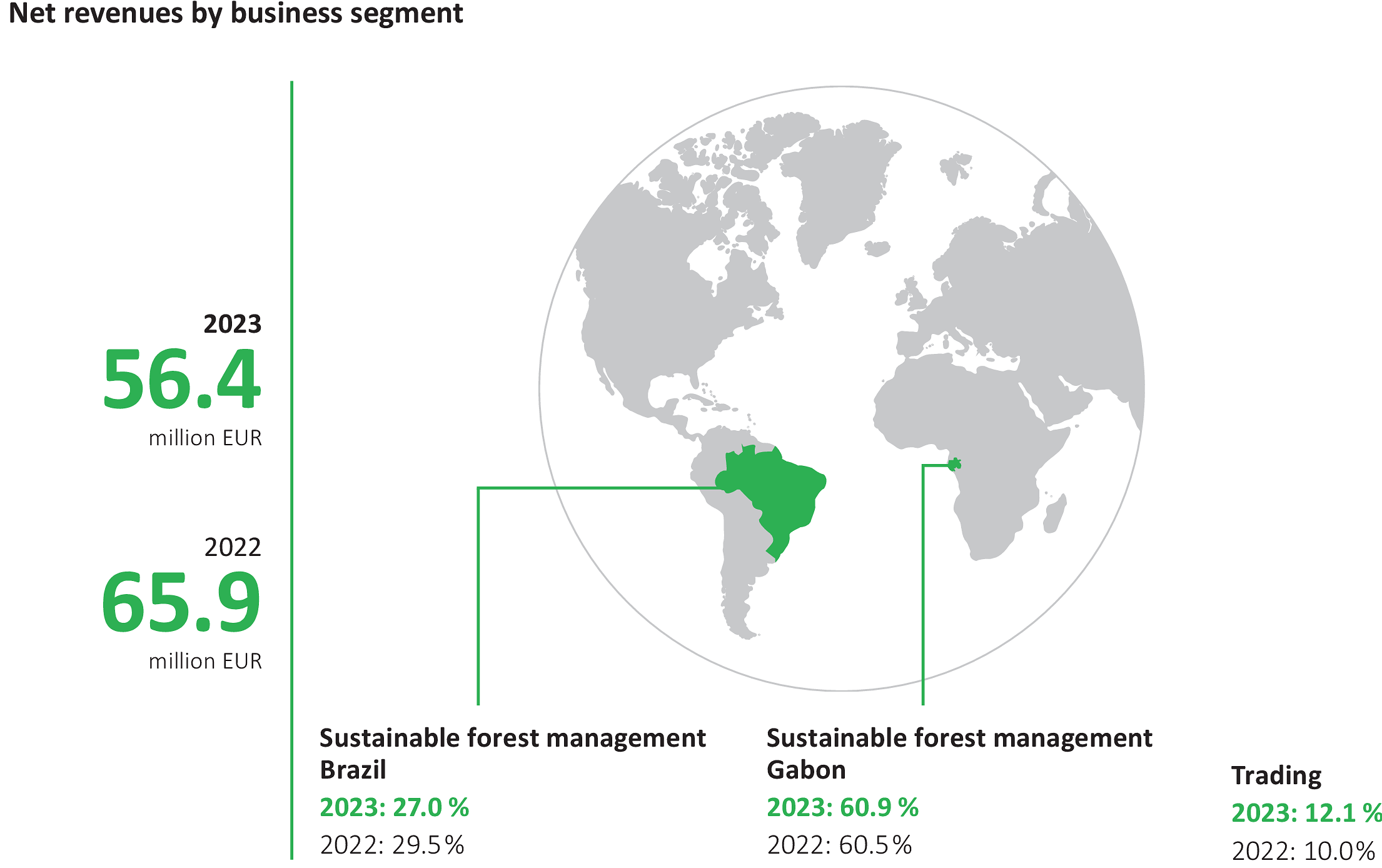

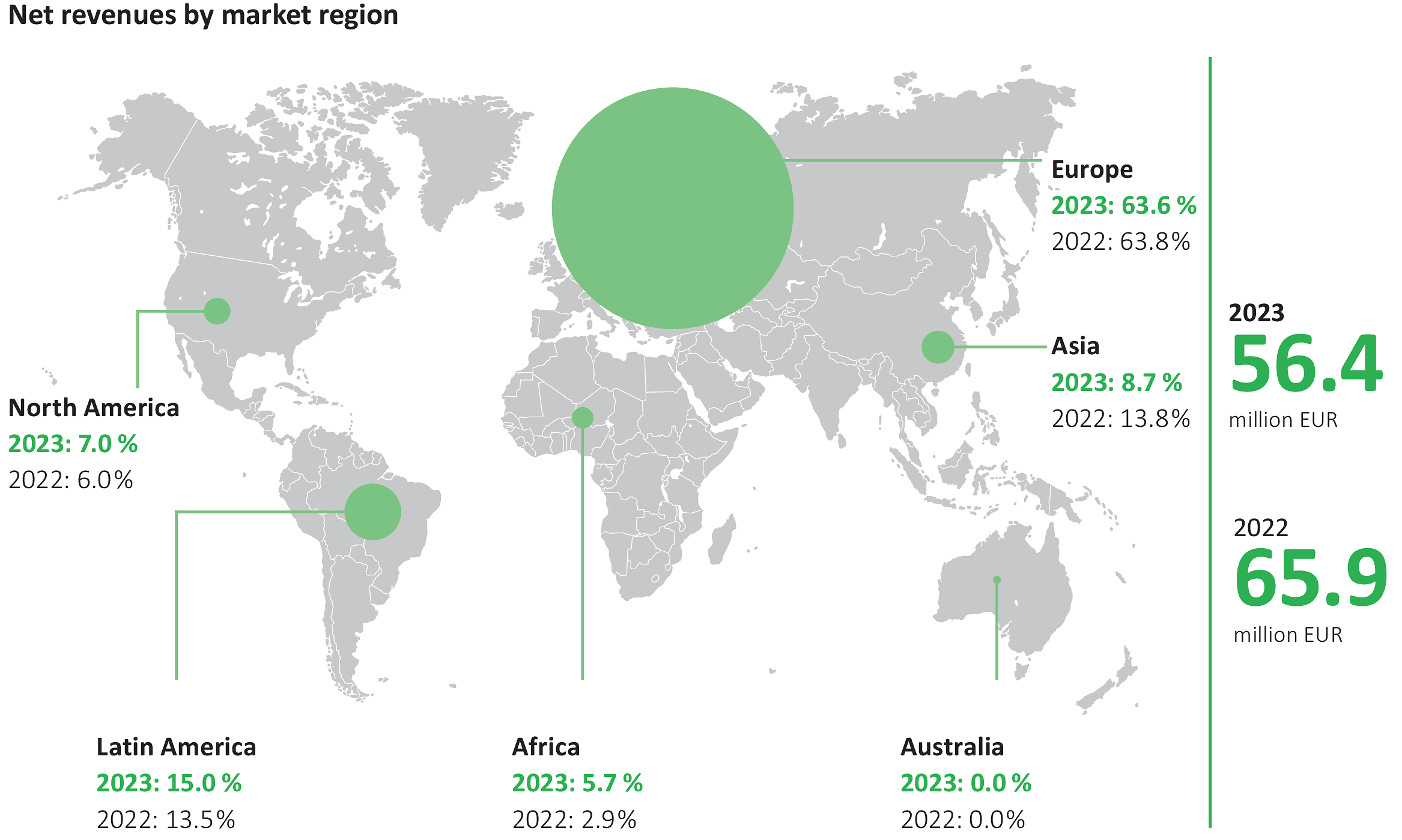

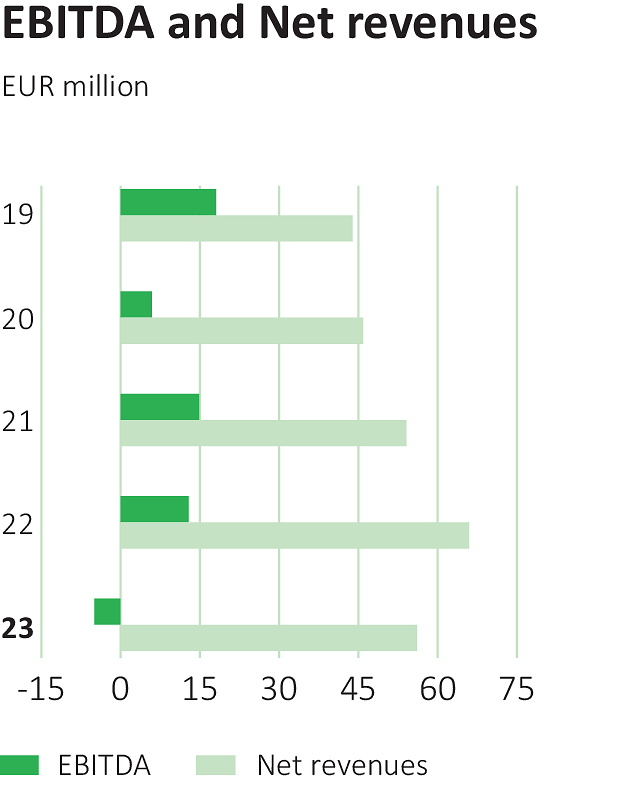

44 380 |

|

46 186 |

|

54 299 |

|

65 866 |

|

56 401 |

| Depreciation, amortization and impairments |

|

4 494 |

|

3 882 |

|

4 329 |

|

6 417 |

|

4 247 |

| Depreciation and amortisation |

|

2 239 |

|

3 922 |

|

4 317 |

|

4 115 |

|

4 350 |

| Impairments |

|

635 |

|

–40 |

|

12 |

|

2 302 |

|

–103 |

| EBITDA |

|

18 450 |

|

5 769 |

|

15 066 |

|

13 332 |

|

–5 143 |

| in % of net revenues |

|

41.6% |

|

12.5% |

|

27.7% |

|

20.2% |

|

–9.1% |

| EBIT |

|

13 956 |

|

1 887 |

|

10 738 |

|

6 915 |

|

–9 390 |

| in % of net revenues |

|

31.4% |

|

4.1% |

|

19.8% |

|

10.5% |

|

–16.6% |

| Net result |

|

7 973 |

|

–2 181 |

|

4 685 |

|

965 |

|

–12 717 |

| in % of net revenues |

|

18.0% |

|

–4.7% |

|

8.6% |

|

1.5% |

|

–22.5% |

| Balance sheet total |

|

131 076 |

|

109 443 |

|

117 438 |

|

136 399 |

|

132 684 |

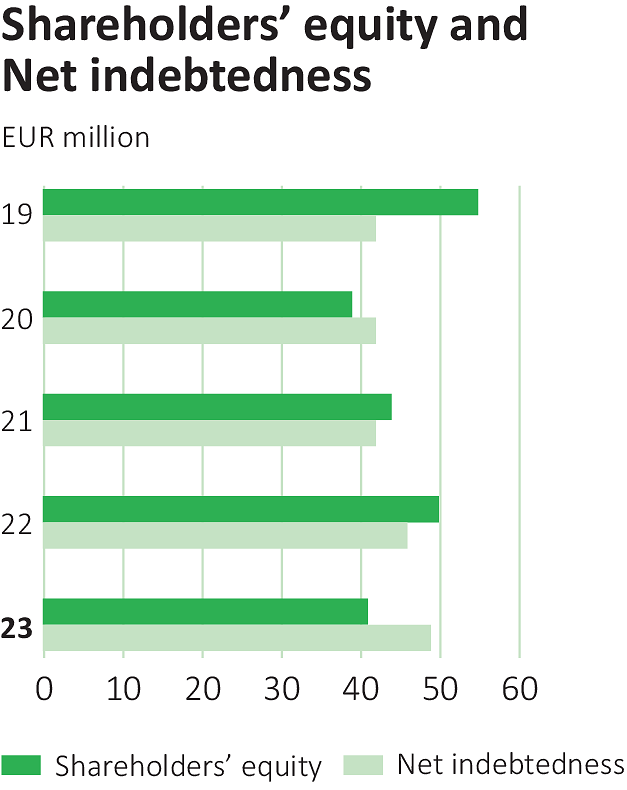

| Shareholders' equity |

|

55 104 |

|

39 309 |

|

44 438 |

|

50 362 |

|

41 115 |

| in % of the balance sheet total |

|

42.0% |

|

35.9% |

|

37.8% |

|

36.9% |

|

31.0% |

| Net indebtedness |

|

41 631 |

|

41 910 |

|

42 184 |

|

46 145 |

|

48 935 |

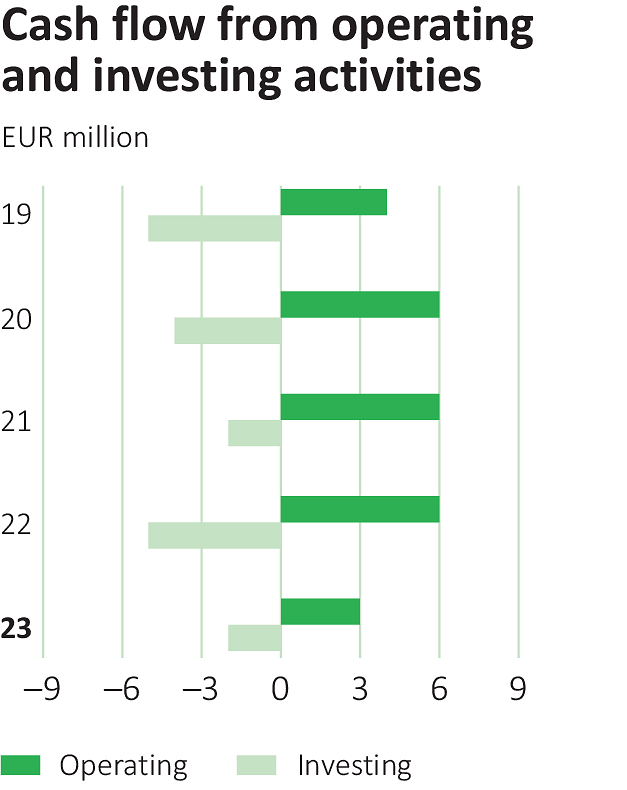

| Cash flow from operating activities |

|

3 806 |

|

5 868 |

|

6 049 |

|

6 348 |

|

2 665 |

| Investments/acquisitions |

|

–4 650 |

|

–4 038 |

|

–2 332 |

|

–5 495 |

|

–1 707 |

| Average full-time-equivalent employee |

|

1 498 |

|

1 548 |

|

1 560 |

|

1 539 |

|

1 259 |