|

|

|

|

|

|

|

|

|

|

|

| |

|

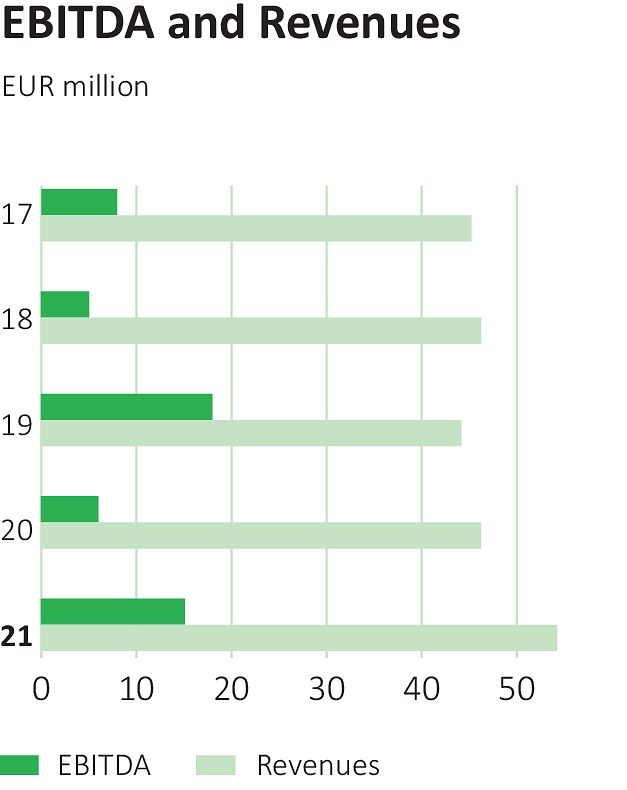

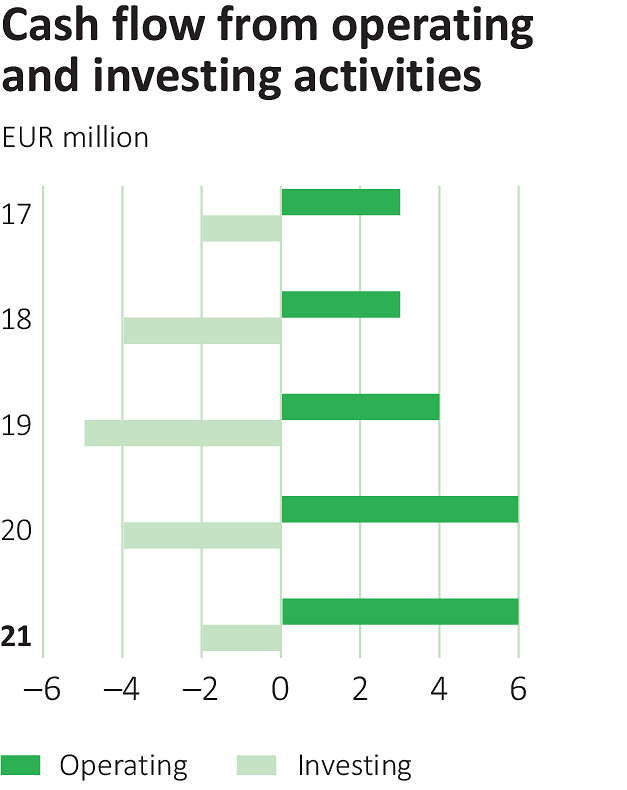

2017 |

|

2018 |

|

2019 |

|

2020 |

|

2021 |

| Revenues |

|

44 997 |

|

46 349 |

|

44 380 |

|

46 186 |

|

54 299 |

| Depreciation, amortization and impairments |

|

4 681 |

|

3 416 |

|

4 494 |

|

3 882 |

|

4 329 |

| Depreciation and amortisation |

|

4 699 |

|

3 435 |

|

2 239 |

|

3 922 |

|

4 317 |

| Impairments |

|

–18 |

|

–19 |

|

635 |

|

–40 |

|

12 |

| EBITDA |

|

8 210 |

|

5 111 |

|

18 450 |

|

5 769 |

|

15 066 |

| in % of revenues |

|

18.2% |

|

11.0% |

|

41.6% |

|

12.5% |

|

27.7% |

| EBIT |

|

3 529 |

|

1 695 |

|

13 956 |

|

1 887 |

|

10 737 |

| in % of revenues |

|

7.8% |

|

3.7% |

|

31.4% |

|

4.1% |

|

19.8% |

| Net result |

|

1 643 |

|

–1 717 |

|

7 973 |

|

–2 181 |

|

4 686 |

| in % of revenues |

|

3.7% |

|

–3.7% |

|

18.0% |

|

–4.7% |

|

8.6% |

| Balance sheet total |

|

71 405 |

|

73 435 |

|

131 076 |

|

109 443 |

|

117 438 |

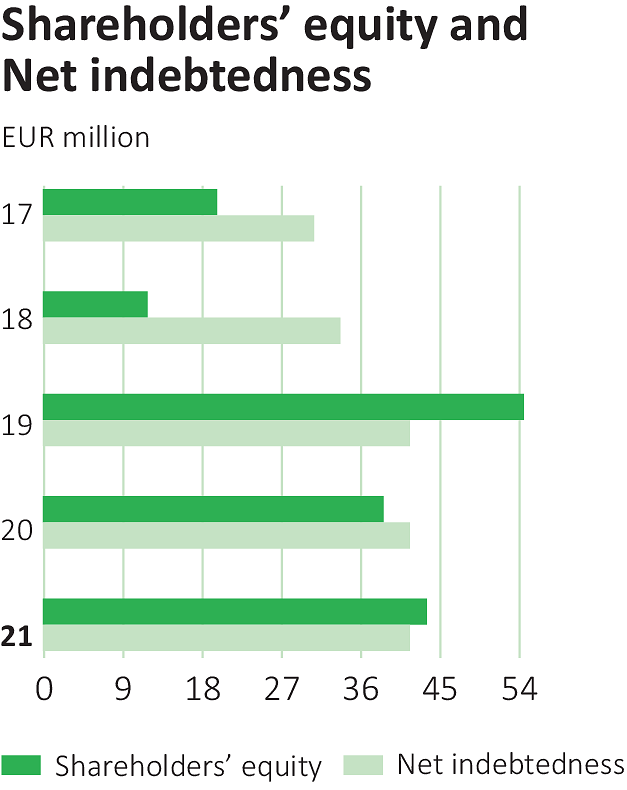

| Shareholders' equity |

|

20 095 |

|

11 614 |

|

55 104 |

|

39 309 |

|

44 438 |

| in % of the balance sheet total |

|

28.1% |

|

15.8% |

|

42.0% |

|

35.9% |

|

37.8% |

| Net indebtedness |

|

31 283 |

|

34 441 |

|

41 631 |

|

41 910 |

|

42 184 |

| Cash flow from operating activities |

|

3 351 |

|

3 307 |

|

3 806 |

|

5 868 |

|

6 049 |

| Investments/acquisitions |

|

–2 244 |

|

–3 542 |

|

–4 650 |

|

–4 038 |

|

–2 332 |

| Average full-time-equivalent employee |

|

1 340 |

|

1 408 |

|

1 498 |

|

1 548 |

|

1 540 |